2025 Real Estate Appraised Valuation Notices

the first opportunity to file a 2025 appeal was FEBRUARY 28, 2025 for non-commercial properties and march 10, 2025 for commercial properties. if you miss this time frame to appeal, you will have another opportunity to appeal the valuation once you receive your 2025 tax bill in november. this appeal needs to be filed with the treasurer's office and will require a partial payment.

The 2025 Annual Notice of Appraisal and Classification for non-commercial real estate parcels in Wyandotte County were mailed on Friday, February 28th, and had an appeal deadline of Saturday, March 29th. The 2025 Annual Notice of Appraisal and Classification Commercial real estate parcels in Wyandotte County were mailed on Monday, March 10th, and have an appeal deadline of Wednesday, April 9th.

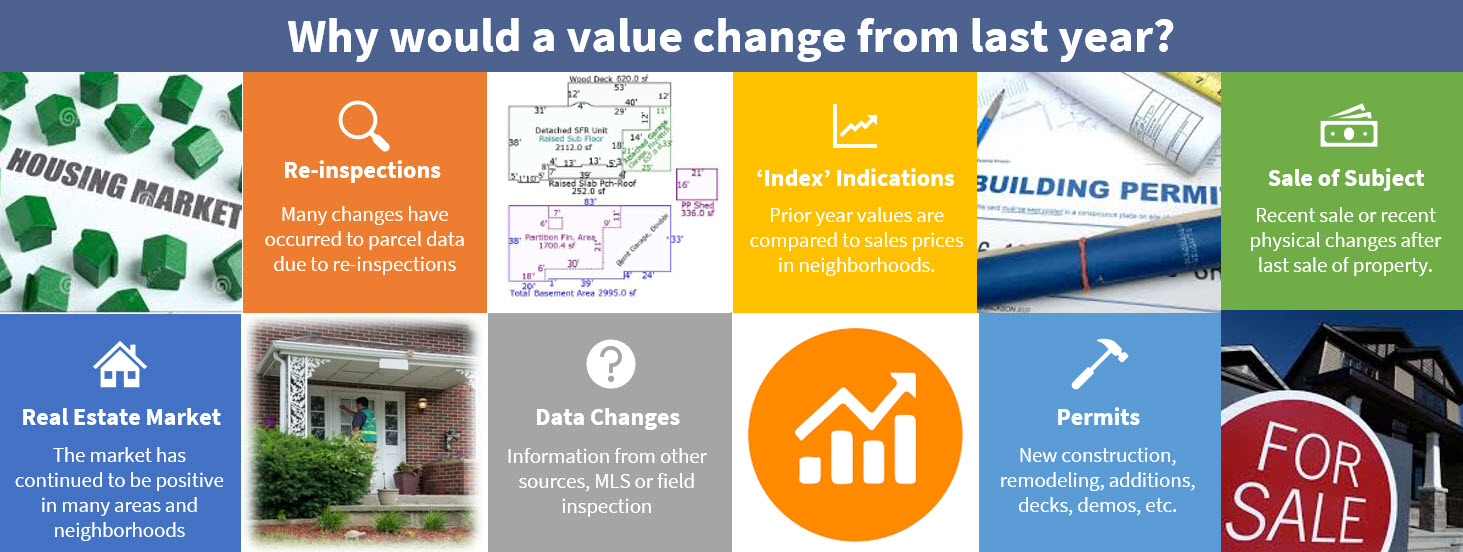

The Appraiser’s Office is required to value property at a fair market value as of January 1st of each year with the exception of agricultural land, which is valued by its agricultural use. Valuing at a fair market value means that value should reflect what’s happening in the real estate market.

The housing market has remained strong, and the county has experienced a continuation of increasing home sale prices. Due to a shortage of housing supply, increased housing demand, and revitalization in various areas of the county, most property owners should expect to see an increase in their valuation.

Once a property owner receives their new valuation, if the appraised value is more than they feel they could reasonably get if the property was sold, or if they feel the classification is incorrectly assigned, then they should consider an appeal. Property owners who wish to file an appeal, can do so by submitting the appeal form using the online submission available at wycokck.org/AYPVO, hand deliver, or mail to the Appraiser’s Office at 8200 State Avenue, Kansas City, KS 66112.

Upon receipt of a timely appeal, the Wyandotte County Appraiser’s Office will schedule an informal appeal meeting. Informal appeal meetings can be either by phone, based on evidence submitted or held virtually. It is important to submit documentation to support the appeal. Documentation can include such items as a recent fee appraisal, pictures of the condition that cannot be seen from the exterior of the property, comparable properties that have sold that the property owner feels more closely represent the value of the property, etc.

Once the informal appeal deadline has expired and a property owner did not initiate a timely appeal, the next opportunity to appeal is when the 2024 tax bills are due, which is on or before December 20, 2024.

(JPG, 220KB)

(JPG, 220KB)

Learn about the Appraisal Process through our Helpful Videos

|

|

|

|